Ontario Bill of Sale | Free Template

Meet with a notary public and draft your document

Meet a licensed professional online to draft your document. Get it completed in minutes.

$99.95

$249.00

• Save: $149.05 (60%)

$99.95

$249.00

• Save: $149.05 (60%)

Featured NotaryPro Expert in Toronto

How it Works

Fill out our simple

online form with your

information.

Review and approve

the generated

document.

Once your document

is ready, you can

Notarise!

Meet with a notary public and draft your document

Meet a licensed professional online to draft your document. Get it completed in minutes.

$99.95

$249.00

• Save: $149.05 (60%)

$99.95

$249.00

• Save: $149.05 (60%)

Featured NotaryPro Expert in Toronto

Contents

-

What is a Vehicle Bill of Sale in Ontario?

-

An “As Is” Clause in an Ontario Bill of Sale

-

Why is an Ontario Bill of Sale Important?

-

Who Keeps a Vehicle Bill of Sale in Ontario?

-

Format of a Bill of Sale in Ontario

-

Information to Include in Your Ontario Bill of Sale

-

HST for a Corporate Bill of Sale in Ontario

-

Submitting Your Vehicle Bill of Sale to Service Ontario

-

Commissioning Your Ontario Bill of Sale

-

Frequently Asked Questions

What is a Vehicle Bill of Sale in Ontario?

An Ontario Vehicle Bill of Sale is a document that confirms the sale of a vehicle. It can be used for private transactions between individuals and business-to-individual sales. Registered dealerships typically issue their own invoices instead.

Simply put, it serves as a proof of purchase and legal receipt, confirming that a vehicle has changed hands. ServiceOntario requires a Bill of Sale for a buyer to register their vehicle and pay the retail sales tax (for private sales). Without a Bill of Sale, a vehicle transfer cannot be completed.

With a Bill of Sale, a buyer typically accepts a vehicle in “as is” condition (also known as sold as seen). If warranties or payment terms are required, a more detailed Sales Agreement is recommended instead.

A Bill of Sale is also commonly referred to as a:

- Proof of purchase

- Sales receipt

Do you have Questions about your Bill of Sale Document ?

An “As Is” Clause in an Ontario Bill of Sale

Selling an item “as is” means that it’s sold in its current condition, and the buyer accepts the item with all its flaws. A Bill of Sale with an “as is” clause doesn’t include any warranties. The seller isn’t responsible for any flaws, provided they haven’t concealed them or lied about them.

As such, a Bill of Sale protects the seller from having to provide a refund for any issues that arise after the buyer receives the item. NotaryPro’s Bill of Sale template automatically includes an “as is” clause to protect the seller.

Why is an Ontario Bill of Sale Important?

In Ontario, a Bill of Sale is more than just a receipt. It’s a document that protects both the buyer and seller, serving as proof of purchase. A Bill of Sale records the transaction, but ownership is only legally transferred when the buyer registers the vehicle with ServiceOntario. Here’s why it matters:

Registration Requirement

If you’re buying a used vehicle privately, you must register it at ServiceOntario within six days of the sale. A completed Bill of Sale is one of the key documents required for that process.

Proof of Ownership

A Bill of Sale confirms that a transaction took place on a specific date and the vehicle’s ownership has legally changed hands. It protects the buyer’s rights and relieves the seller of future responsibility.

Used to Calculate Sales Tax

A Bill of Sale serves as a record of the purchase price. Ontario uses this amount, or the vehicle’s wholesale value (whichever is higher), to calculate the retail sales tax due at registration.

Captures Vehicle Details

A Bill of Sale captures essential details about the vehicle, including its make, model, VIN, date of sale, and price.

Records Payment Terms

A Bill of Sale records the agreed-upon sales price and payment terms between a seller and buyer.

Proof of “As Is” Condition

It demonstrates that the car was sold “as is”, with the buyer accepting the vehicle’s condition at the time of sale.

Declares No Unpaid Debts

By signing a Bill of Sale, a seller declares that there are no unpaid debts/liens or liabilities. Buyers should still review the UVIP to confirm there aren’t any outstanding liens before completing the purchase.

Valid for Family Transfers

Even when a vehicle is gifted or transferred between close relatives, a Bill of Sale may still be required to complete registration. In some cases, tax exemptions apply, but the record of transfer is still important.

Note: If you’re purchasing from a registered dealership, they’ll provide an official Bill of Sale or invoice. You don’t need to draft one yourself.

Who Keeps a Vehicle Bill of Sale in Ontario?

It’s recommended to prepare two signed originals of the Bill of Sale: one for the buyer and one for the seller. Having two copies means each party retains its own proof of the transaction.

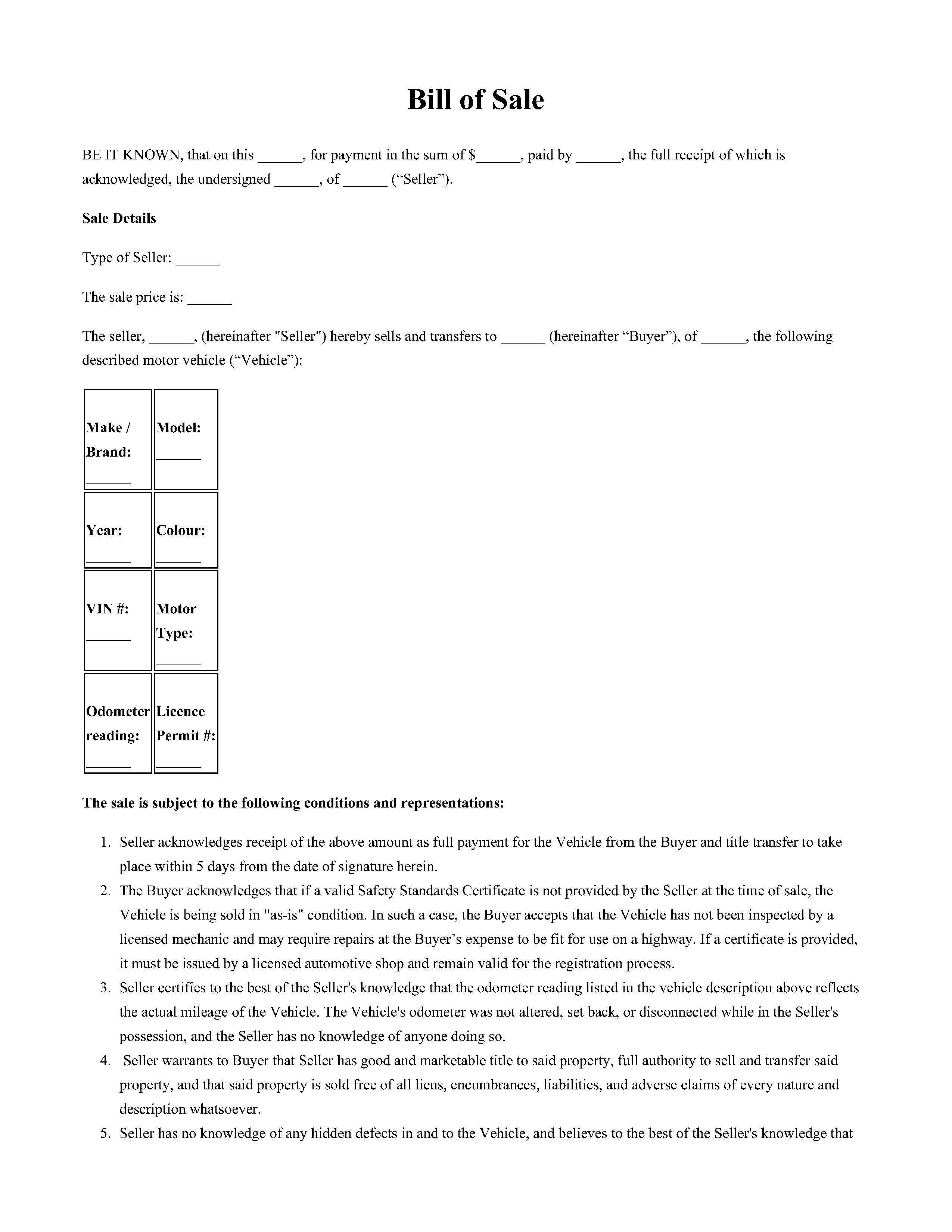

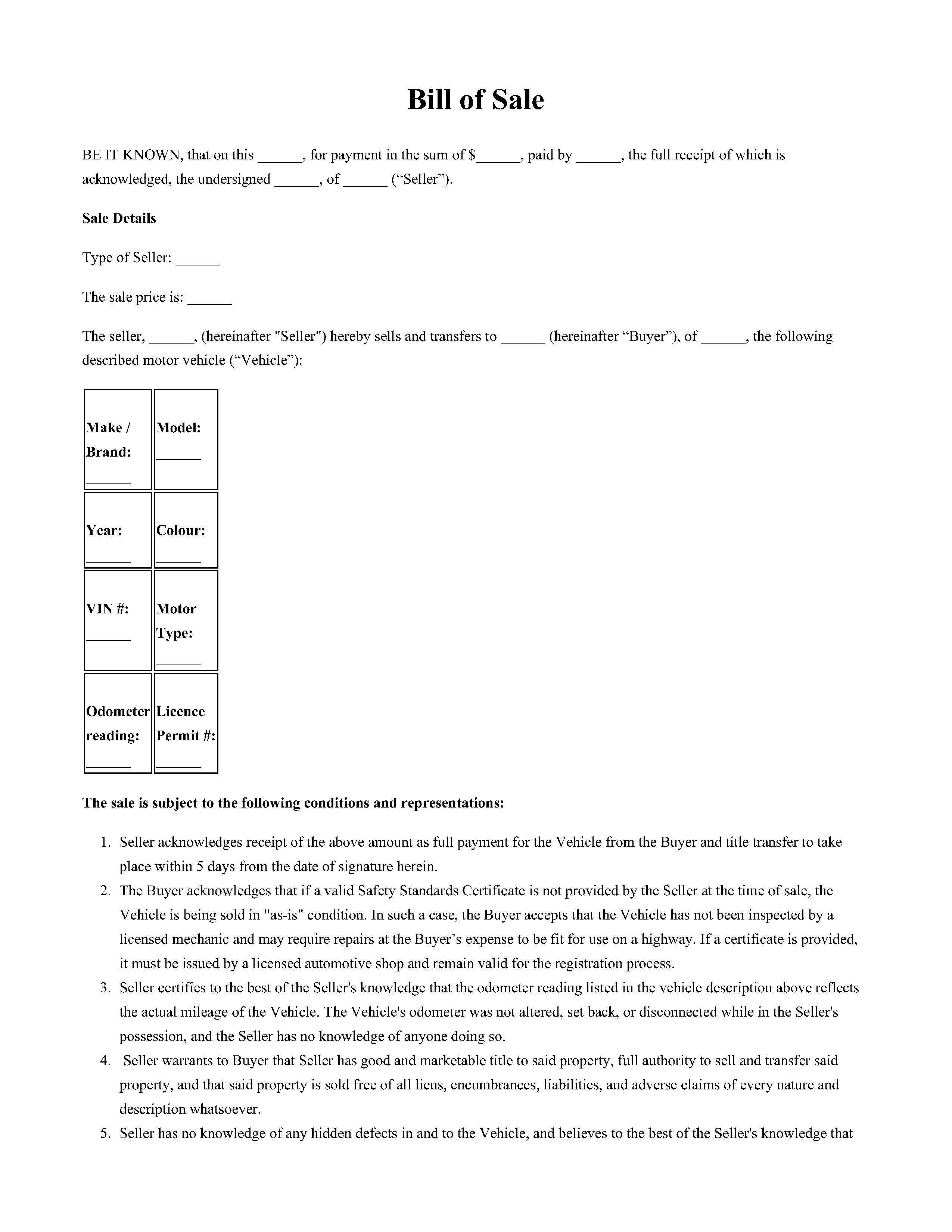

Format of a Bill of Sale in Ontario

Unlike some provinces, Ontario doesn’t have a standardized form for a Bill of Sale. As long as the key information is included and both parties sign it, the format is flexible.

An Ontario Bill of Sale can be in the following format:

- A Bill of Sale section filled out in the Used Vehicle Information Package (UVIP)

- A typed or handwritten document you create yourself, or

- A downloadable template from a trusted source

Information to Include in Your Ontario Bill of Sale

Creating a Vehicle Bill of Sale doesn’t need to be complex or tedious. What’s important is that all the elements and information required in a Bill of Sale are present. With that in mind, here are the important details that should be included in your Bill of Sale:

Buyer Information

- Full legal name

- Address

- Contact information

Seller Information

- Full legal name of the individual seller or corporation

- Address of the individual seller or corporation

- Contact information

- HST number (for corporations)

- HST amount collected displayed (for corporations)

- Full legal name and title of the signing officer (for corporations)

Vehicle Details

- Vehicle identification number

- Make, year, and model

- The vehicle’s power source (gas, diesel, electric)

- Vehicle’s colour

- Body type (e.g., SUV, truck, sedan, etc.)

- Odometer reading at the time of the sale

Sale details

- Date of sale/Purchase date

- Method of payment: cash, e-transfer, etc. (optional)

- Any special terms (e.g., sold “as is”)

- Final purchase price (this will be used to calculate sales tax)

- Some exemptions may apply. For instance, for a family-gift transfer, you must submit the Sworn Statement for a Family Gift of a Used Motor Vehicle in Ontario. Feel free to use our template to draft one up in minutes.

Signatures

- Signature of the buyer

- Signature of the seller

- Date of both signatures

- Signature of an authorized official (e.g., notary public or commissioner of oaths)

Use our free, fillable Vehicle Bill of Sale to save time and ensure yours isn’t missing any important information.

HST for a Corporate Bill of Sale in Ontario

If you’re a business or corporation, the Bill of Sale should include your company’s legal name as the seller. You also need to add your business address and HST number, and HST amount. HST is typically collected by the seller at the time of sale, and the buyer doesn’t pay tax again at ServiceOntario.

When the seller is a business, an authorized representative of the corporation should sign the Bill of Sale.

Submitting Your Vehicle Bill of Sale to Service Ontario

Service Ontario will accept a photocopy or facsimile of your Bill of Sale if the:

- The original Bill of Sale is viewed and photocopied at a ServiceOntario centre;

- original and the photocopy of your Bill of Sale are viewed at the ServiceOntario centre; or

- A facsimile is sent directly from the seller to the ServiceOntario centre.

1. Originals

ServiceOntario does not accept any other photocopy or facsimile versions of the Bill of Sale.

- ServiceOntario needs the original, signed Bill of Sale. It can be handwritten or printed; both are fine, as long as it’s the original.

- Pre-printed forms are okay; if you’re using a pre-printed Bill of Sale, the HST/GST number can be handwritten. These are common with businesses.

Note: Private sellers don’t need to include an HST/GST number.

2. Copies/Faxes (rare exceptions)

ServiceOntario accepts a photocopy or fax only if one of these is true:

- A staff member views the original and makes a photocopy at the centre;

- A staff member views both the original and your photocopy together at the centre; or

- A seller faxes the Bill of Sale directly to a ServiceOntario centre.

3. Dealer or Company Sales

- If a dealer/company prepares a Bill of Sale, it must be on their official letterhead (with the company name, logo, and address).

Commissioning Your Ontario Bill of Sale

Commissioning your Vehicle Bill of Sale isn’t mandatory, but we recommend doing so. Commissioning adds credibility to the document, which is important for high-value transactions

This involves a notary verifying your identity, and you officially affirming that the details in your Bill of Sale are accurate.

You can meet with a notary online to have your Bill of Sale commissioned via a secure video call in 7 minutes, from anywhere with Wi-Fi. Then, you’ll get your signed and commissioned Bill of Sale instantly by email — no long waits necessary.

Frequently Asked Questions

Yes. A Bill of Sale can be handwritten or typed. What matters is that all the details are complete and you bring the original, signed document to ServiceOntario.

Most jurisdictions do not require witness signatures on a Bill of Sale. However, having one or two witnesses present at signing provides stronger evidence that both parties agreed to the sale’s terms. This added attestation can be valuable if the transaction is later disputed or proceeds to litigation.