Partnership Agreement

How it Works

Fill out our simple

online form with your

information.

Review and approve

the generated

document.

Once your document

is ready, you can

Notarise!

Contents

-

What is a Partnership Agreement?

-

Purpose of a Partnership Agreement

-

Commissioning Your Partnership Agreement

-

Details to Include in a Partnership Agreement

-

Frequently Asked Questions

What is a Partnership Agreement?

A Partnership Agreement is a legal document that outlines how two or more individuals (or entities) run a business for profit. It’s a good idea for all partnerships to have a Partnership Agreement in place.

This Agreement details each partner’s roles, rights, responsibilities, and contributions. It also establishes critical guardrails for a business, such as its profit and loss distribution.

A Partnership Agreement helps you and your partner(s):

- Prevent misunderstandings and agree on critical matters.

- Develop a legal framework to navigate disputes or unforeseen events.

- Align with your obligations to the business.

- Nail down profit-sharing expectations.

- Remain protected from certain risks.

Do you have Questions about your Partnership Agreement Document ?

Purpose of a Partnership Agreement

A Partnership Agreement helps to prevent misunderstandings and ensure you and your partner(s) agree on critical business matters. Essentially, it provides a legal framework that empowers you to manage disputes and unforeseen events, like a partner’s withdrawal.

It also outlines how each partner is liable for the partnership''s debts, obligations, and actions, as well as those of other partners.

As your business develops, all partners should be aligned on roles, decision-making processes, and profit-sharing arrangements. Essentially, this Agreement illustrates expectations, protecting everyone from potential risks. Having a Partnership Agreement helps ensure that everyone gets the most out of the partnership with minimal confusion.

If you don’t have a Partnership Agreement, provincial partnership law will apply by default. For example, the Ontario Partnership Act governs partnerships in Ontario. A Partnership Agreement allows you to define your own rules rather than relying on default legal provisions.

Commissioning Your Partnership Agreement

While not legally required in all Canadian provinces, having your Partnership Agreement commissioned is highly recommended. Commissioning your Agreement adds credibility and authenticity to it, making it easier to enforce in court if required.

That said, if you’re using your Partnership Agreement for international purposes, having it commissioned may be mandatory. You can meet with a notary public online to have your Partnership Agreement commissioned in under 7 minutes. Complete the process from anywhere with Wi-Fi, even if your partner(s) are in a different country.

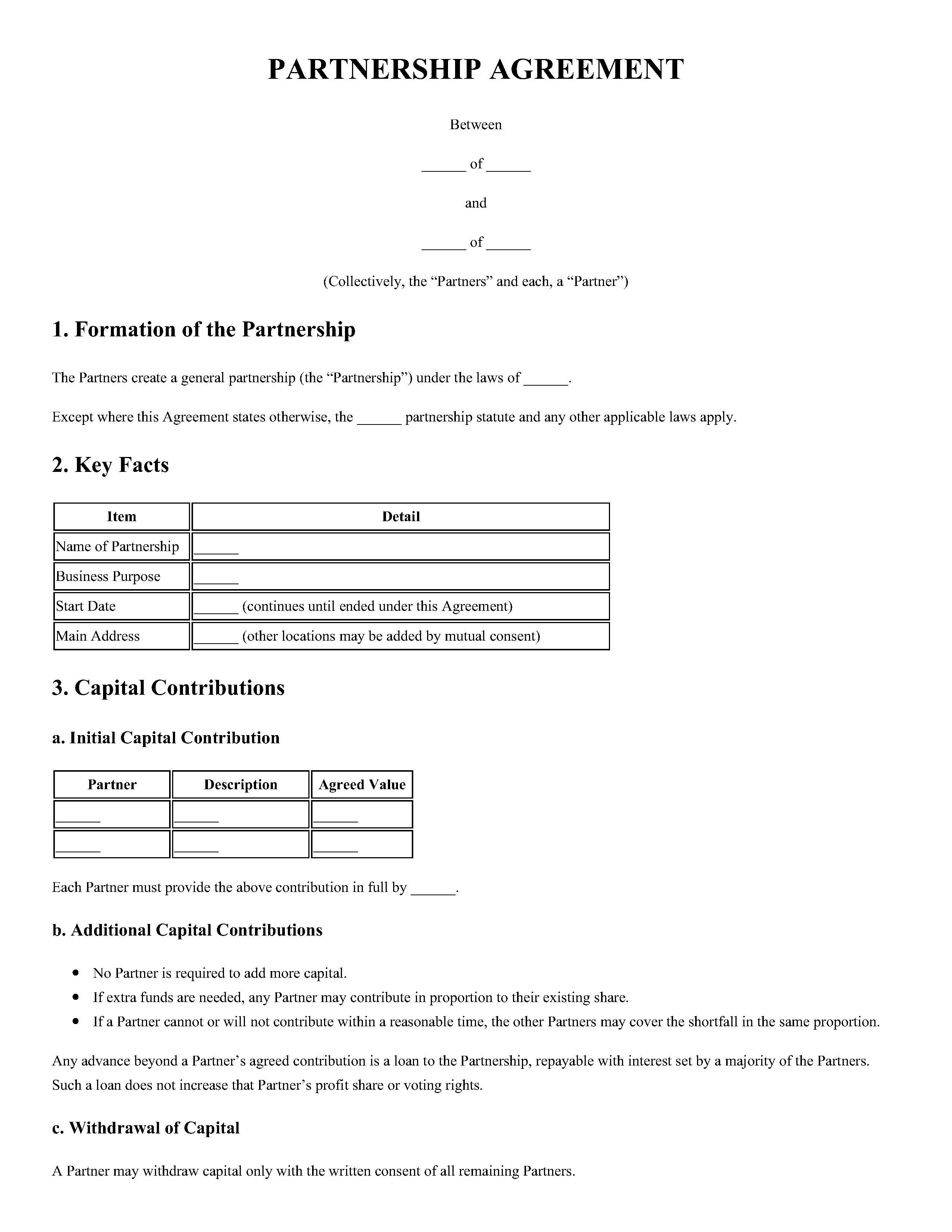

Details to Include in a Partnership Agreement

In Canada, a Partnership Agreement should include specific information for it to be valid and enforceable. This information is outlined below:

Basic Business Details

- Your business name and its address

- The date the partnership began

- The date the partnership will end, if known

- A description of the product or service you offer

- Each partner’s full name and address

- The partnership’s fiscal year-end date

New Partner Rules

Outline whether new partners can join the partnership, and if so, when, and whether voting is required for admittance. Having rules regarding new partners can eliminate confusion and conflict in the future.

Length of the Partnership

Many partnerships operate for an indeterminate length of time, with no predetermined end date. Having said that, sometimes owners expect their business to dissolve after reaching a certain milestone or a set number of years. If applicable, include your corporation’s termination date.

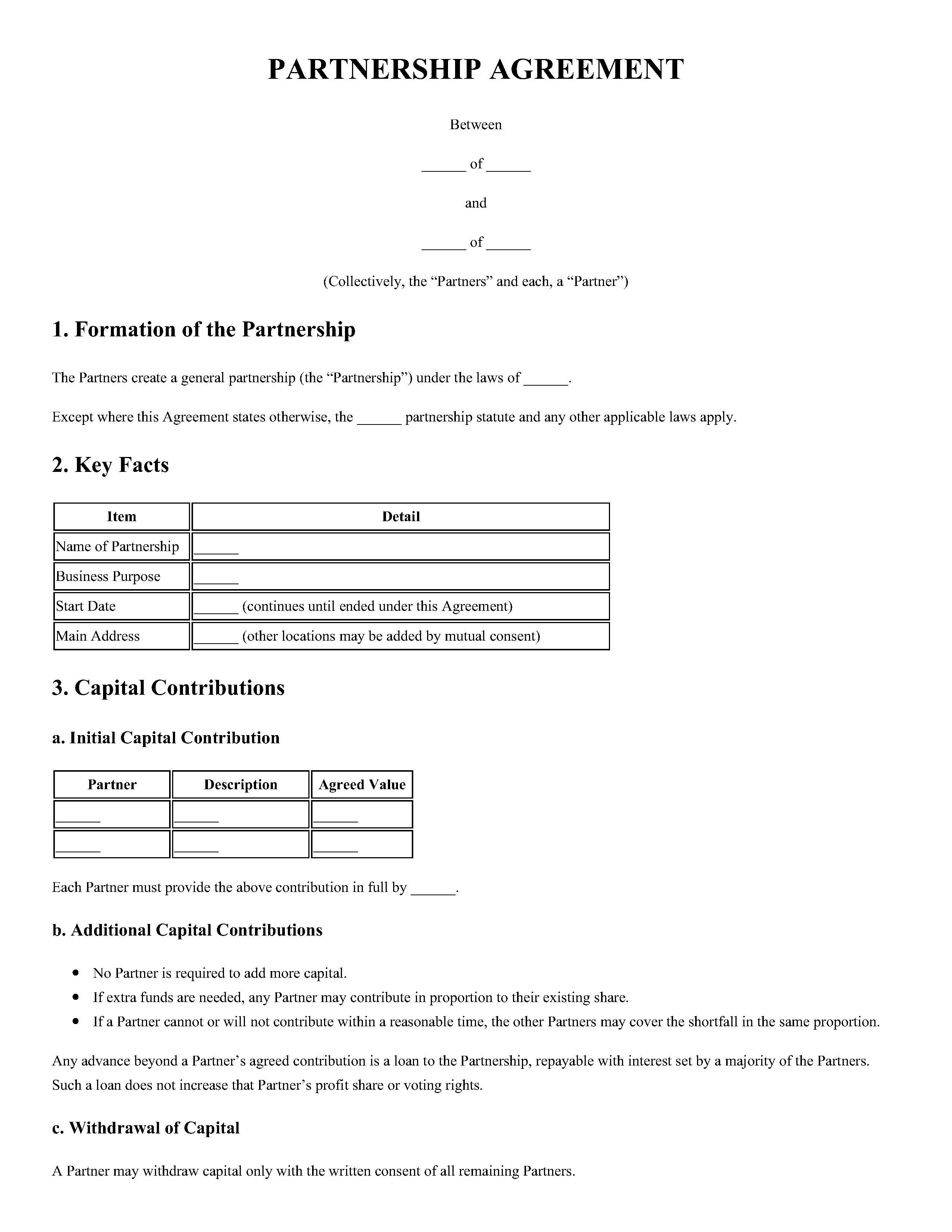

Partnership Compensation

Note whether partners are compensated for work beyond their share of profits — partner compensation is separate from profit and loss distribution. It can include salaries, management fees, and other payments for time and services provided. Outline how and when partners are compensated, particularly when they contribute varying levels of effort or assume operational roles.

Capital Contributions and Ownership Percentage

Outline each partner’s capital contributions, so you have a paper trail and everyone is on the same page. Capital contributions include time, effort, and funds spent to manage the business. Partners can contribute cash, equipment, property, services, and more.

Day-to-Day Responsibilities

Define each partner’s roles and responsibilities to help owners manage expectations. Outline who is responsible for daily tasks and other notable responsibilities to avoid confusion and misunderstandings. You can also include a mandatory meeting schedule and specify who is authorized to call meetings.

Withdrawal Requirements

Include a mandatory notice period before a partner can withdraw from the business to ensure everyone is protected and prepared. This gives owners enough notice to make critical decisions should one or more partners withdraw.

Dissolution Details

Outlining how you would treat a dissolution sets clear expectations for an often stressful time. You can establish steps that must be taken to facilitate the dissolution of your company. You can also note whether the business would dissolve upon a partner’s withdrawal or not.

Decision-Making Protocols

It’s best to implement rules around decision-making, since decision-making disputes can create significant conflict. You can include a voting system for certain decisions or another method to enforce checks and balances.

Authority Provisions (Binding Power)

Define partner authority, also known as binding power, within your agreement. Binding power means the authority to make decisions and enter into agreements that bind the business. By specifying who has binding power, you reduce the risk of certain partners entering into unfavourable agreements.

Dispute Resolution

Your Agreement should include the steps you’ll take to resolve disputes among partners. You can add a mediation clause, meaning you will resolve disagreements among partners, without court intervention.

Profit and Loss Distribution

Establish how profits and losses will be distributed among partners; they can be distributed equally, by percentage of ownership, or in proportion to contributions. Also include when profit can be withdrawn from the business and by whom.

Ownership Percentage

Ownership percentage is typically determined by each partner’s financial, asset, or property contributions to the business, but it can include other factors too. That said, some partnerships allocate ownership equally, regardless of the contributions each partner offers.

Non-Compete Clause

Add a non-compete or post-withdrawal clause to limit a partner’s ability to compete with the business after they leave. Canadian partnership law doesn’t imply such restrictions by default, so including them in your agreement gives your partnership significant protection. Without this clause, a former partner could use information or client lists to divert business, which can be costly for remaining partners.

Agreement Changes

Explain how changes to the agreement can be made over time. Typically, amending a Partnership Agreement requires the consent and signatures of all partners. This ensures that changes are agreed upon collectively and documented appropriately.

Frequently Asked Questions

Yes, a Partnership Agreement can be customized to reflect the specific needs, goals, and circumstances of the partners. Each partnership is unique, so the agreement should be tailored to address the partnership’s specific characteristics.

A Partnership Agreement should outline the procedures for a partner’s departure, which might include giving notice to the other partners and addressing the division of assets, liabilities, and any outstanding obligations.

In most jurisdictions, a formal Partnership Agreement is not legally required for a partnership to exist. However, having an agreement in place is highly recommended to avoid misunderstandings, conflicts, and uncertainties among partners.